Should I work in Big 4 Financial Due Diligence (FDD)? – Work-life reality, exposure & exit opportunities

In this mini-series, we explore some of the most talked about Accounting & Audit exit opportunities to uncover what work-life reality is really like, what it can do for your career trajectory & the available exit opportunities. Articles in this mini-series include:

- [THIS ARTICLE] Should I work in Big 4 Financial Due Diligence (FDD)?

- Should I work in Financial Planning & Analysis (FP&A)?

- Should I work in Equity Research?

- Should I work in Big 4 Valuations?

- Should I work in Restructuring?

- Should I work in Product Control?

- Should I work in Internal Audit?

In this article, we’re covering Big 4 Financial Due Diligence (FDD) – a subset of the Transaction Services (TS) department.

Have you ever wondered:

- What FDD is actually all about?

- Is it just glorified Accounting & Audit?

- How is it different to Investment Banking/M&A?

- What clients, teams, senior partners etc. will I get exposure to?

- What is the work-life reality like?

Let’s start from the top…

Why does the Financial Due Diligence team exist?

Corporates and PE firms often don’t have the spare capacity or deep technical Accounting expertise within their own in-house Finance teams to support on day-to-day deal execution (such as M&A and other transactions). That’s where the Big 4 FDD team comes in.

The FDD team supports corporate clients and financial buyers (e.g. PE firms) on purely the financial aspects of the deal in question i.e. they’ll utilize their technical accounting know-how to audit the financials provided by Senior Management of the target company.

After thorough analysis of past trading experience, the team will recommend purchase-price (and other) adjustments to the client/acquirer in order to ensure they are paying an appropriate price and limiting the downside risk of any “black holes” post-transaction.

The support needed by the client will depend on the size of the company, transaction, and cash available to fund external support, alongside the complexity of the deal. More complexity = more outside advisory required.

Work life reality & client/senior exposure

- As mentioned, this team supports on purely the technical financial aspects of the deal, meaning you’re unlikely to get exposure to the negotiations, strategic & commercial analysis, deal structuring, valuation, legal diligence, HR/People organization, and the many many other aspects of the M&A deal lifecycle. The “birds-eye” view of the entire workings of the deal will sit with the in-house Corporate Development M&A team. Even Investment Bankers supporting on an M&A transaction will not be privy to all of such information.

- Much like an Investment Banking team would, the FDD team will spend time pitching to businesses for advisory work and are brought in at various moments of a live transaction, sometimes even for discrete ad-hoc tasks. It could be related to a certain financial specialism (e.g. acting as a sense check on price offered to the target company, or an in-depth view of the assets for sale, say, how to value an oil & gas field) or utilising Accountancy skills to test the accuracy of financials provided by a target company.

- The FDD team will be responsible for providing a report to the client on the integrity of the numbers / identifying potential financial risks (there’s your auditing coming in useful!). Think: normalizing EBITDA, net debt or coming up with Net Working Capital adjustments for clients to put in their own M&A models…ultimately, purchase price adjustments.

- Often larger corporate clients will want to keep their cards close to their chest and so do not share all aspects of the deal with their external advisors. For example, they’ll likely choose not to share detail on the “synergies” they hope to realize from the deal, although you might be asked to review the financials provided by the target company that feed into such calculations.

- Perhaps contrary to expectations, not every team in Transaction Services are financial modelling whizzes and the FDD team generally have limited (or no) on-the-job experience in this area.

- Similar to M&A (and the large majority of TS) FDD have nauseating and unpredictable work hours; when you have a project you could be at work until 2-3 AM for several days, when you don’t have a project you might not be billing any hours for weeks whilst sitting uncomfortably at the office twiddling your thumbs.

- Team-wise, you’ll be part of a large group of ~30 people, so plenty of opportunity for after-work drinks (which the culture tends to be ripe for).

- Throughout projects you’ll likely have exposure to Partner/Director level within your own firm giving you the chance to learn directly from them and soak up their knowledge / sales & client-schmoozing techniques.

- The Partners/Directors are the members of the team who ultimately manage the client relationship. Lower-level staff are unlikely to have much (if any) notable client-interaction.

- Further, with regards to strategic reviews and commercial & market analysis work that the Big 4 FDD teams tend to mention on their websites(!), in reality corporate clients will carry this out themselves in-house, with a reputable Strategy Consultant (e.g. McKinsey, Bain, etc.) or a specialist consultant (i.e. someone with deep expertise in a specific industry area). What you see on the Big 4 websites is simply marketing spiel to help the firm sound valuable and all-encompassing, and are services your Partner will try and sell to clients (but rarely actually wins).

This mini-series intended to give you a quick and dirty overview to some of the most talked about Accounting & Audit exit opportunities. This particular post covered Big 4 Financial Due Diligence (FDD) – a subset of the Transaction Services (TS) department, with other roles coming soon!

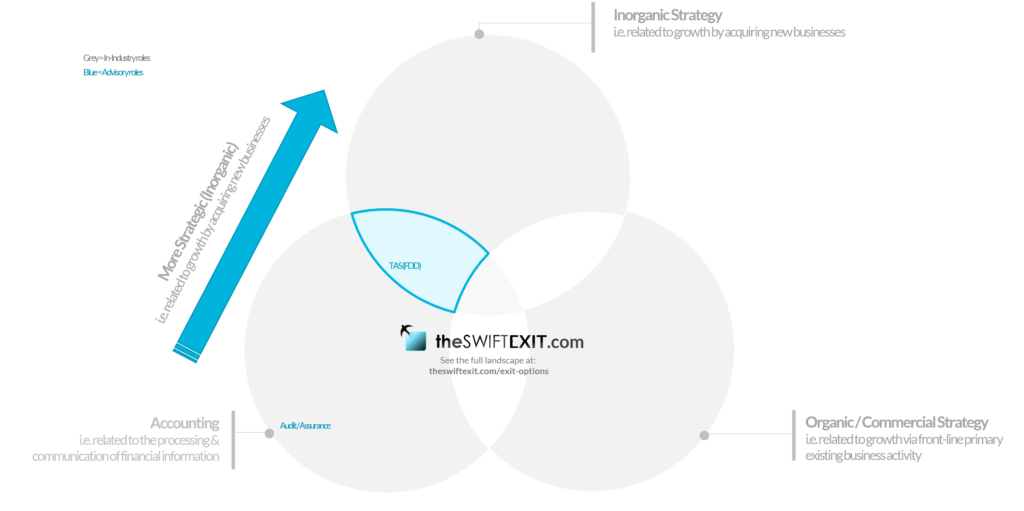

Now if this is an area you’re considering, I strongly encourage you to check out our map of the landscape of Accounting & Audit Exit Opportunities, including Transaction Services / FDD to find out:

- Where does FDD sit in relation to the other Transaction Services teams?

- How does TS Advisory compare to similar in-industry teams?

- What are my chances of moving into Investment Banking/PE/Hedge Funds/Corporate Dev/M&A?

- How does the salary compare?

- Are there other post-audit career paths suited to me?

- And more…!

Exit Options | Mapping the post-accounting & audit landscape

A lot of the clients we coach ask about moving into more strategic & commercial roles after spending time in traditional accounting & audit, but don’t know where to start or even what opportunities exist …so-much-so that we’ve put together a map of the landscape of accounting exit opportunities, which I encourage you to check out!

Want to land (and master) more strategic and commercial roles?

Learn how to upskill beyond your technical accounting & audit background in the first (and only) online course built specifically for accountants. Through interactive modules, case studies, and real-world applications, you’ll learn how to confidently build financial models, assess business opportunities, and everything else needed to contribute meaningfully to strategic decision-making. Build hard commercial skills to future-proof your skill set and prove you can translate your accounting background into a commercial context with the Commercial Finance & Strategy – Principles and Execution online course.

Spice up your CV/Resume for the post-accounting & audit world

We’ve created a digital guide specifically to help those of you applying for more commercial & strategic roles. Our straight-talking CV/Resume advice for Accountants/Auditors is the only guide that is highly-specific to the traditional accounting & audit background: we give you real-life good & bad examples for showcasing your experience for strategic roles, the best structure & content to win over recruiters, a strategy for distributing your CV/Resume, interview advice, and more!

Want personalised advice from one of our Co-Founders?

We’ve been where you are and can help you forge your swift exit. Click here to Get Coached.